Thanksgiving and Black Friday have gone mobile. Women are driving the web. And Hatchimals, the Nintendo Entertainment System, and Baby Alive will top 2016 holiday gift wish lists. Know the trends that will define the holiday shopping rush.

Smartphones have become consumers’ trusted shopping companions. Mobile shopping searches surged in 2015, passing desktop for the first time on Thanksgiving and Black Friday.1 This year, we see supershoppers continuing to turn to their phones for research and purchases.

In fact, for many consumers, smartphones have become a “door-to-the-store.” And that is particularly true during the holidays. Seventy-six percent of people who search for something nearby on their smartphone visit a related business within a day.2

As we head into one of the busiest shopping weeks of the year, Google data reveals how consumers will shop and what they’ll buy.

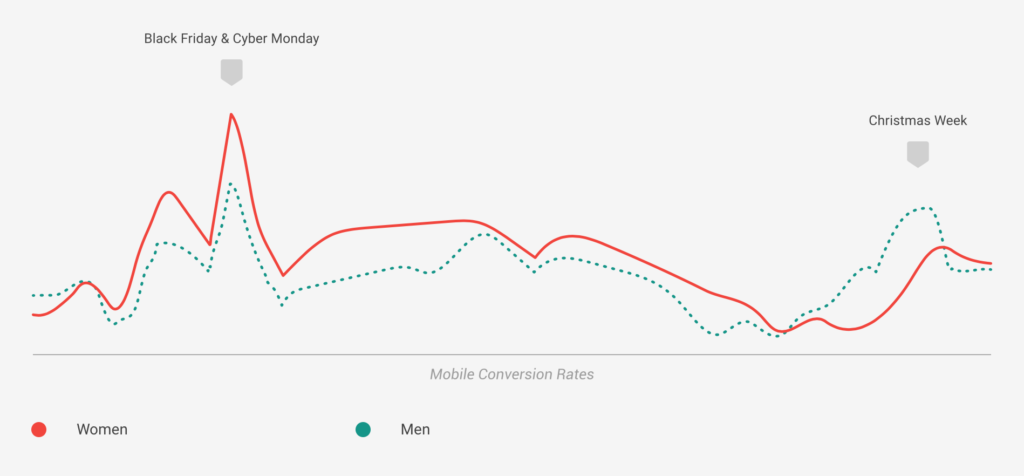

Women purchase early while men play the waiting game

Women drive the mobile web, searching for and buying products at twice the rate of men throughout the holiday season. The week of Christmas, however, men are more likely to complete their mobile purchases.3

Hatchimals and Nintendo top shoppers’ gift lists this year

Consumers are already on the hunt. Top trending product searches for the first two weeks of November include the Nintendo Entertainment System and Hatchimals—that’s right, stuffed animals that hatch.4

TOP TRENDING PRODUCT SEARCHES FOR THE FIRST TWO WEEKS OF NOVEMBER

Hatchimals

Nintendo Entertainment System

Baby Alive

Trolls

DJI Phantom 3 + 4

Sony PS4 Pro

Cozmo

Pokémon

Num Noms

RC cars

And while many shoppers can zero in on what they want, others search for inspiration and ideas. Last year, mobile searches related to “unique gifts” grew more than 65% compared to the 2014 holiday season, while mobile searches related to “cool gifts” grew more than 80%.5

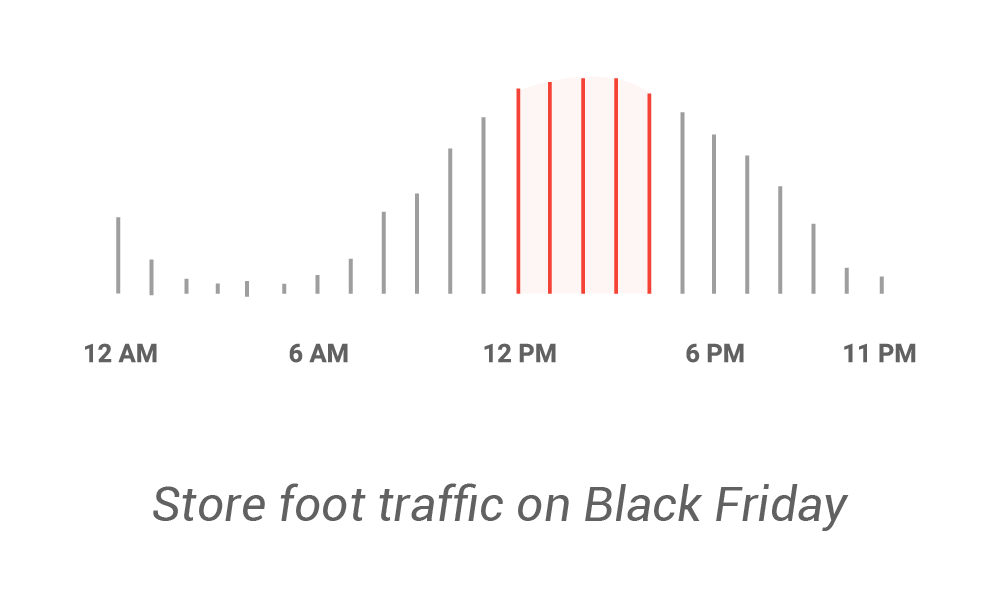

On Black Friday, stores are most crowded in the afternoon

Although Black Friday is often associated with early birds, store foot traffic typically peaks in the afternoon between noon and 4:00 p.m. But people are shopping all day long.6 Shopping searches on mobile remain steady throughout the day as shoppers take advantage of Black Friday deals and plan their trips to the store.7

New Englanders love a good deal

Though Black Friday weekend is the rare retail event that pulls even reluctant shoppers into stores, some areas of the country are more interested in deals than others.

By 10:00 a.m. on Black Friday, more than one-quarter of New England shoppers are already on the hunt for a good deal, having stepped inside a department store or shopping center. The rest of the country lags behind an hour.8 And the same is true on mobile marketing; people living in New Hampshire search for more product-related deals than people in other states.9

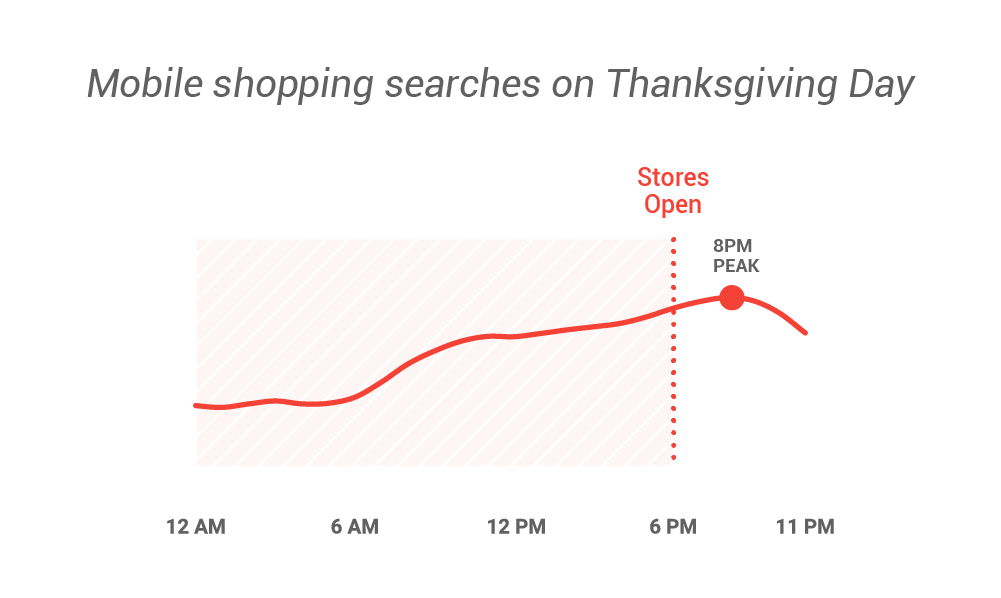

But even before stores open—and long after they close—consumers are shopping. Last Thanksgiving, 59% of shopping searches on mobile took place before stores opened. Shopping continued well into the evening, with mobile shopping searches peaking at 8:00 p.m.10

The way consumers shop and behave during the holiday season is rapidly changing, from the way they create their gift lists to the way they purchase. Shoppers are proving that—both with their fingertips and their feet.

For more data about mobile search trends and shopper foot traffic on Black Friday, check out our infographic “What Google Data Reveals About Black Friday Shoppers.”

Sources

1 Google Search Data, U.S., Nov. 2014 vs. Nov. 2015.

2 Google/Purchased Digital Diary: “How Consumers Solve Their Needs in the Moment,” representative sample of U.S. smartphone users = 1,000, local searchers = 634, purchases = 1,140, May 2016.

3 Google Analytics consulting serivces , aggregated, anonymized data from U.S. accounts that are opted in to sharing benchmark data; mobile only, shopping vertical, Nov. 15, 2015 – Dec. 31, 2015.

4 Google Shopping Insights, U.S., all devices, Nov. 1 – Nov. 13, 2016.

5 Google Search Data, U.S., apparel, home & garden, beauty & personal care, computers & electronics, gifts, toys & games, photo & video, Nov. – Dec. 2014 vs. Nov. – Dec. 2015.

6 Google Data, aggregated, anonymized store traffic for clothing, electronics, and toy stores from a sample of U.S. users who have turned on location history, Nov. 2015.

7 Google Search Data, U.S., apparel, computer & electronics, and games & toys. mobile only. Nov. 2015.

8 Google Data, aggregated, anonymized store traffic for clothing, electronics, and toy stores from a sample of U.S. users who have turned on location history; store traffic after midnight attributed to Black Friday, Nov. 2015.

9 Google Search Data, U.S., apparel, home & garden, beauty & personal care, computers & electronics, gifts, toys & games, photo & video; mobile only, Nov. 2015.

10 Google Data, aggregated, anonymized store traffic for clothing, electronics, and toy stores from a sample of U.S. users who have turned on location history; Google Search Data, U.S., apparel, computer & electronics, and games & toys; stores considered open after 6:00 p.m. on Thanksgiving, Nov. 2015.

#Google #nubeinternet #googlepartners

If you want to know more about the NubeInternet or have questions about digital marketing. You can call us at (210) 996 7176 or you can also start a conversation with us by filling in this contact us form. We will be happy to hear from you.